I'm thinking about dropping BNZ. They're getting worse and worse. What are SBS like?

Announcement

Collapse

No announcement yet.

What are you seeing with the bank financing environment?

Collapse

X

-

Free online Property Investment Course from iFindProperty, a residential investment property agency.

-

From that Squirrel article above. This sounds good to me:

What does this all mean for property investment?

We are likely to see a return to yield.

We are likely to see more prevalent rental increases in the next six months across the board. This will be coupled with a continued softening and slowdown of the property market. As investors find it harder to borrow there will be less activity and a focus on consolidation.

It’s not all negative though. This change is likely to present opportunities as some investors will be looking to consolidate their positions and reduce exposures. These may be enforced by the bank as they find top-ups not as easy to come by or interest only roll-overs being denied. These situations should bring good stock onto the market at more affordable prices.

Squadly dinky do!

Comment

-

Rents are rising and prices flat. That works. I like yield.Free online Property Investment Course from iFindProperty, a residential investment property agency.

Comment

-

Don't expect banks to loosen lending anytime soon

Tuesday, November 06, 2018

Article by Kris Pedersen

As investors become increasingly aware of how much the lending landscape has changed from that of a few years ago, a question I am receiving a lot is, “When will we see the banks relax mortgage lending criteria again?”

Whilst we saw the slight relaxing of LVR restrictions at the start of the year, over roughly the same period we have also seen:

• Debt servicing restrictions continuing to tighten with an emphasis on lenders assessing all of clients’ mortgages on high interest rates (7-8%). This means that lending guidelines are quite distorted when compared with the actual performance of a property portfolio.

• Interest-only loans getting harder to access and frequently banks are refusing to roll over for new periods when an existing period comes up for expiry. Many investors will not have felt the impact of this yet. However, when combined with the general increased costs of being a landlord, we expect to see more investors coming under cashflow strain over the next few years.

• The Royal Commission in Australia looking into misconduct in the financial services sector – in particular, poor lending practices and the lack of emphasis banks placed on customers’ expenses when assessing loan applications. There was a flow-on effect of this in New Zealand.

Regarding the last point, my team and I personally experienced severe tightening with one of the major banks recently, as loan assessors reported back to us that they are getting told to look much more closely at applications in general.

On the flipside, this is creating opportunities in the burgeoning non-bank market, with many of the lenders we deal with stating large increases in mortgages being written. While in most cases these lenders are charging a premium on what you’d pay if you could have accessed the finance through a mainstream lender, the fact that often these lenders seem to operate with a higher degree of common sense, innovation and lack of fishhooks, shows that this segment will only continue to grow in market share. There is still more funding required for reasonably priced longer-term requirements in this space but there are signs that this is starting to come. Several operators have introduced prime versions of products in recent months with rates significantly beneath those of their traditional offerings.

The one area where relaxing may apply shortly is the increasing talk that we will see a further pulling back of the LVR restrictions late this month when the Reserve Bank does its next Financial Stability Report. ANZ, BNZ and Kiwibank economists have all stated that they expect this to eventuate with a likely increase in the investment space back to 70%. The positive is that even if it doesn’t eventuate then, we are very likely to see it announced in May next year at the following review.

Unfortunately don’t expect to see other relaxing in Bank Land any time shortly.

Source: https://www.gra.co.nz/articles-by-kr...nding-criteria

Comment

-

This is a good article and reflects the large increase in non bank funding that is happening right now. In Australia banks have tightened even more so resulting in a massive 300% increase in non bank lending over the last 18 months. Hard to say what it is here but looking like 35 to 40% and if any of the Royal Commission (in Australia) proposals hit the banks here then the increase in non bank lending can only go up. This is great news as the banks dominate the lending scene and it's about time they had competition!www.ilender.co.nz

Financial Paramedics

Comment

-

FYI

Finance challenges for property investors

Tuesday, December 11, 2018

Article by Salesh Chand

Banks have recently tightened their criteria and changed their serviceability rules so much, that it has become much harder for investors to get finance. And for large investors, it is almost impossible.

The RBNZ has told banks that they must adopt ‘sensible lending’ practices, which means they need to stress test their clients’ ability to make their loan repayments. What do we mean by stress test? They are now testing investors on 8% principal and interest over 25 years, and reducing the rental income they’ll take into account by 25–30%.

Bearing in mind that current interest rates are around 4.5%, and many investors will take out interest-only loans, these new criteria can very quickly make a cashflow positive investor look like their cashflow is negative. Result? The bank won’t approve finance. I’ll illustrate with an example.

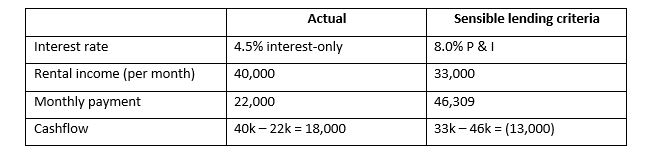

Suzanna has built a good portfolio of properties and has $6 million of debt. Her current repayments are in the ‘Actual’ column of the table below. If she were to approach the bank today, they would assess her as per the ‘Sensible lending criteria’ column.

Based on today’s reality, Suzanna has $18,000 positive cashflow, so can easily service her loans. However, using the bank’s criteria, she is backwards by $13,000, which means she fails the bank’s serviceability test and they will not lend her anything.

Even if we look at the situation when Suzanna comes off interest-only onto P & I at today’s rates, meaning her monthly payments increase to $30k, she is still ahead by $10,000.

How can investors manage in this ‘sensible lending’ environment?

There are a number of things property investors can do to be able to continue investing under these stricter rules, including:

- Arrange lines of credit with your bank now, before you need them.

- Reduce your credit card limits before applying for finance – even if you only ever use a fraction of your credit card limit and you pay your entire balance off each and every month, the banks look at the credit you have available and assume you will use all of it when they assess you. You can increase your limits later if you need to.

- Don’t apply for a new credit card until you have your lending in place.

- Make friends with your banker – if they know you and you treat them well, they will be inclined to do what they can to help you. For example, buy them a Christmas gift, take them out for coffee occasionally.

- To meet the new bank servicing requirements, many investors will need a bigger deposit, so you may want to consider working with a JV (joint venture) partner. Lots of our clients do this, and as long as you have a robust shareholders’ agreement, JVs can work very well.

There are good opportunities to be had in the cooling property market. To be able to take advantage of them, you need to be aware of the new lending serviceability criteria and put things in place so you can qualify for finance

Source: https://www.gra.co.nz/articles-by-sa...erty-investors

Comment

-

Yeap, this left me quite short on new borrowing that I was looking for for an opportunity that came my way. Kicking myself for paying down debt heavily last year....Originally posted by Don't believe the Hype View PostGood post Chris - Thanks.

We recently (last week) talked to ASB about taking a big chunk (millions) of our lending. They said they’re working of 70% of rent, 8% at P&I on an 18 yr paydown.

Pretty aggressive buffers in their numbers.

Comment

-

this is why we never pay down debt. We keep an offset account with all our spare funds instead of paying down the debt. That weybwe keep as much control as we can.Originally posted by elguapo View PostYeap, this left me quite short on new borrowing that I was looking for for an opportunity that came my way. Kicking myself for paying down debt heavily last year....

Comment

-

davo36 - do you think they’re being responsible or creating a rod for their own back? Tightening I understand but there is a balance and tightening too far could result in a self fulfilling prophecy and a downward spiralOriginally posted by Davo36 View PostYes the new conditions are much tougher.

Almost like the banks are being sensible.

After 10 years of acting like drunken sailors, they'be turned into buttoned up to the neck school marms.

Comment

-

I think this is actually happening to some degree. The asymmetry between tighter lending, falling prices, and rising rents is what has me looking again seriously. That's a far more interesting environment for me.Originally posted by Don't believe the Hype View Postdavo36 - do you think they’re being responsible or creating a rod for their own back? Tightening I understand but there is a balance and tightening too far could result in a self fulfilling prophecy and a downward spiral

Comment

-

Comment