Forgive me its along time since I read it ( I purchased it along with other texts when I was trying to work out what money is and how it works ). It was an engrossing text. It starts talking about four mega trends: An age wave, Information revolution, Climate change, and monetary instability. Theres some discourse on what money is and then four possible Scenarios are discussed: A corporate Millennium with govts disbanded, Caring communities ( after a monetary collapse) Hell on Earth ( survivalists dream) and sustainable development. Lietaer seems quite positive on our potential but akin to Soros sees that we are at a cross roads!! He sees our monetary systems as important in shaping society. Its well worth reading but not at US$400.00 ( what a rip off)

Announcement

Collapse

No announcement yet.

Gold: 1st quarter stats

Collapse

X

-

Interesting. I think we must be in the "monetary instability" phase then.

It's funny, I think people tend to think anyone who starts talking about fractional reserve banking and fiat currencies etc are nuts. Wacko jobs who have lost the plot.

That's kinda how I viewed such 'rants' before I started reading more about it.

I guess I'm now one of the nut jobs

I take it you've watched these:

The Most IMPORTANT Video You'll Ever See (parts 1 of - great videos on basic economics, like what exponential growth is, 70 / % = years to double

- great videos on basic economics, like what exponential growth is, 70 / % = years to double

Posted by: http://www.youtube.com/user/wonderingmind42

Part 1: http://www.youtube.com/watch?v=F-QA2rkpBSY

Part 2: http://www.youtube.com/watch?v=Pb3JI8F9LQQ

Part 3: http://www.youtube.com/watch?v=CFyOw9IgtjY

Part 4: http://www.youtube.com/watch?v=yQd-VGYX3-E

Part 5: http://www.youtube.com/watch?v=qHuwgxrTKPo

Part 6: http://www.youtube.com/watch?v=-3y7UlHdhAU

Part 7: http://www.youtube.com/watch?v=RyseLQVpJEI

Part 8: http://www.youtube.com/watch?v=VoiiVnQadwE

and

A set of 5x videos, starting with:

1. Corrupt Banking System - Cartels Robbing the Public

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

2. Corrupt Banking System - How Money is Created

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

3. Corrupt Banking System - Money is Debt

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

4. Corrupt Banking System - Monetary Reform

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

5. Corrupt Banking System - Warning About the NWO

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

The videos come from this website: http://www.moneyasdebt.net/

Which leads to this list of resources: http://paulgrignon.netfirms.com/Mone...references.htm

Which has this:

Fractional Reserve Parisitism (pdf)

and this one:

What happens when you take out a loan

From The Grip of Death, by Michael Rowbotham

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

Henry Ford, (1863 - 1947) American industrialist and founder of the Ford Motor Company.If a bank makes a loan, nothing is lent, for the simple reason that there is nothing of substance to lend. The bank makes what it terms a 'loan' against the money deposited with it at that time. This is easily done. The bank simply has to agree that the person may take out a loan of, say £10,000. The person can then spend £10,000 and hey presto! £10,000 of new number-money has been created. No one with a bank account is sent a letter telling them that the money in their account is 'temporarily unavailable, because it has been lent to someone else'. None of the original accounts in the bank has been touched, reduced or affected. Nobody else's spending power has been reduced, but £10,000 of new number-money enters the economy at the stroke of a bank manager's pen, but £10,000 of debt has also been created.

Therefore, whoever takes out the loan will then make purchases and payments to other people, who will pay that new money into their bank accounts. The result: more bank deposits! As soon as the loan in the example above is spent, £10,000 will find its way into the bank account of a car dealer or DIY store; £10,000 of apparently new money. This money which has supposedly been 'loaned' - but the banking system doesn't distinguish this fact. It simply registers a new deposit, and regards it as new money. The total deposits in the banking system have therefore increased by £10,000. This is the 'boomerang effect' of a bank loan by which a 'loan' rapidly creates an equivalent amount of new bank deposits in the banking system. This effect was neatly summarised in a statement by Graham Towers, former Governor of the Central Bank of Canada; "Each and every time a bank makes a loan, new bank credit is created - new deposits - band new money".

I have a huge list of places like that. I'll stop there !!!

Oh OK, just one more. This is really good.

You can download and read the book here:

If you can't be bothered to read, then you can just listen to it here:

It starts at about 12mins in.

Here's a detail summary of each chapter:

Comment

-

Here's a little story I made up.

-------------------------

It all started with my friend John. He had $100, and I had a nice big safe, so he asked me to store it for him.

Next thing I know, my friend Bob asked me if he could borrow $90. I'm a kind person, so of course I said yes, and took the $90 out of the safe.

Of course Bob being Bob, he spent the lot down the pub that very night

Bob wasn't so happy, but my friend Ken the landlord was, and he came by the next morning and asked me to keep it safely for him in my safe.

Well word must have been getting round that I'm a soft touch, so blow me down if another friend Mick didn't ask for a loan. This time he only wanted $81, so I open the safe again

I knew that was a mistake. He's had this long-term gambling problem, and guess where the money went. Yep that's right, right into Dave the bookies pocket.

He's a careful chap, and asked me to keep it safe for him.

Then Pete asked for a loan. Only $72.90. I'm obviously too soft, but I give it to him from the money in the safe.

He's got quite a big family, and spent the lot at the local grocers. Ted the grocer came round that evening and asked me to put it in my safe.

At this point I thought I'd better start keeping some notes of all this. I'm starting to forget who borrowed what

Now, lets see, I started with $100 from John.

I've lent out:

$90 to my friend Bob.

$81 to Mick.

$72.90 to Pete.

So altogether I've lent out $243.90. And that's the total debt owed.

Hmmm, that's odd, because I only started with $100 ?(

But what do my various friends think they have now?

Well John thinks he has that original $100.

And Ken the landlord has $90.

And Dave the bookie has $81.

And finally, Ted the grocer has $72.90.

So all up, that's $343.90.

And they say you can't make money for nothing

I just hope my friends don't all turn up at once asking for their money back, or I'm going to get beaten up. I've just looked, and I still only have $100 in the safe

Does anyone want to borrow some money ?

-------------------------

Comment

-

In return you owe:Originally posted by Steve Netwriter View Post

I've lent out:

$90 to my friend Bob.

$81 to Mick.

$72.90 to Pete.

$100 to John

$90 to Bob

$81 to Mick, and

$72.90 to Pete.

They cancel each other out except for the $100 you owe John, which still happens to be sitting in your safe.

Even 17 year old's studying economics at high school learn about the multiplier.

Sssshhh... a little secret.... even if the currency was backed by gold or silver or paua shells or vodka (or whatever), the multiplier would still be an issue unless you tightened the reserve requirements such that every dollar lent had to be backed by an equivalent amount in an approved security (ergo you restrict the money supply greatly).

But say they did tighten the reserve requirements (to the hilt) - that would effectively stop the creation of money that was not backed by the equivalent amount of security (by consigning the multiplier to the history books) - ergo it would restrict the money supply.

What happens to the price of something when (other things being equal) it's supply is greatly restricted - it becomes alot more expensive.

And NZers are starting to whinge about interest rates at only 10%!

They'd be waaaaaaaay higher with the money supply restricted.

MComments may not be relevant to individual circumstances. Before making any investment, financial or taxation decision you should consult a professional adviser.

Comment

-

Mark,

I'd be interested to hear your views on the current financial state of the world.

Are you happy about the US$ being the world reserve currency ?

I just wonder whether you're happy about the US monetary policy.

Do you think they did the right thing by cutting rates below the real rate of inflation ?

Do you think it possible that the US$ will collapse and lose its status as reserve currency ?

Do you see any potential problems with this ?

Why derivatives are getting much more dangerous

Sometimes when you’re scouring the news, you see a statistic that renders you almost speechless. You can't quite get your head around what it really means, you just know that it’s a knockout number.

One such figure came up yesterday. The total ‘value' of global derivatives - financial instruments which are priced on the back of the underlying assets that they track - has now reached a breathtaking $596 trillion, after a mammoth rise over the previous twelve months.

That started the warning lights flashing…

.....

Of course, the $596 trillion is a ‘notional’ amount. It’s the nominal value of all the underlying assets against which bets have been placed. But the actual amount of ‘real’ money at risk is still a massive $15 trillion, equal to almost a quarter of world output.

And within the individual areas there’s one even more eye-catching statistic. The value of contracts in credit default swaps (CDS) - a form of market insurance that investors can buy to protect themselves against corporate bond defaults - more than quadrupled last year to $2 trillion, covering a notional $58 trillion of loan debt.

The very size of all these numbers is just about enough to give the jitters to anyone, on the basis that when things can go wrong, they probably will.

I'd be happy if you could convince me that my worries are unfounded.

If you haven't I highly recommend this talk.

Is the Dollar Doomed?

Hoki88 adalah situs judi wahana untuk bermain game lapak hoki 88 slot online. Daftar dan coba game slot hoki asia terpercaya sekarang juga bersama Karo88.

Hoki88 adalah situs judi wahana untuk bermain game lapak hoki 88 slot online. Daftar dan coba game slot hoki asia terpercaya sekarang juga bersama Karo88.

Some people think this is nothing to worry about.

I don't understand that point of view. To me it is rather significant.

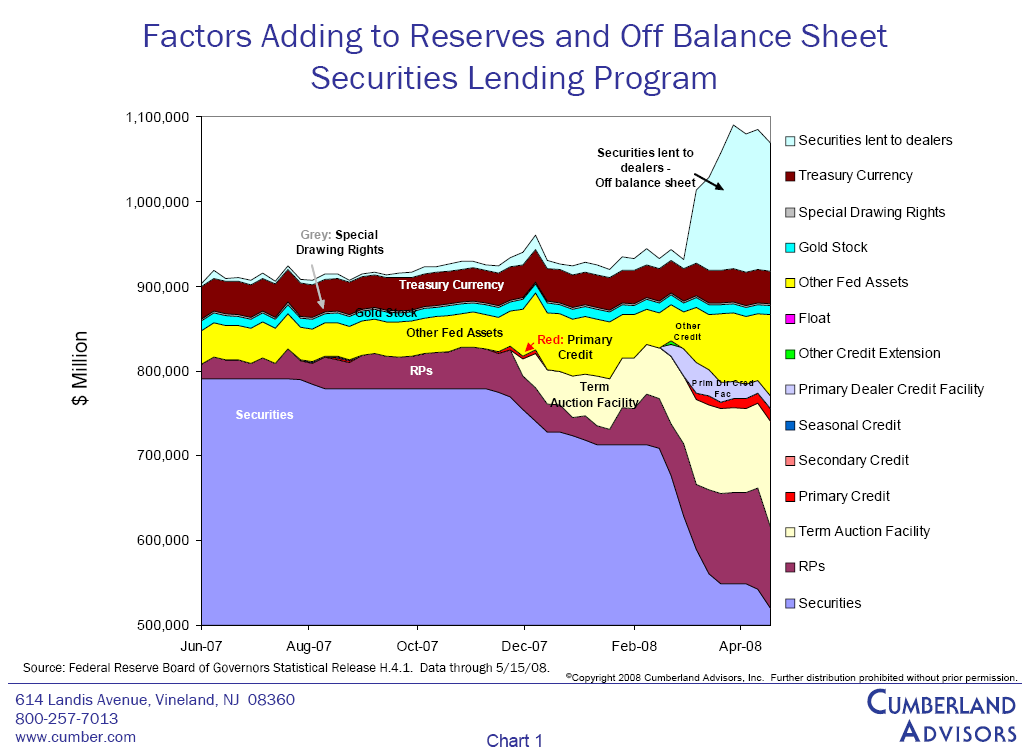

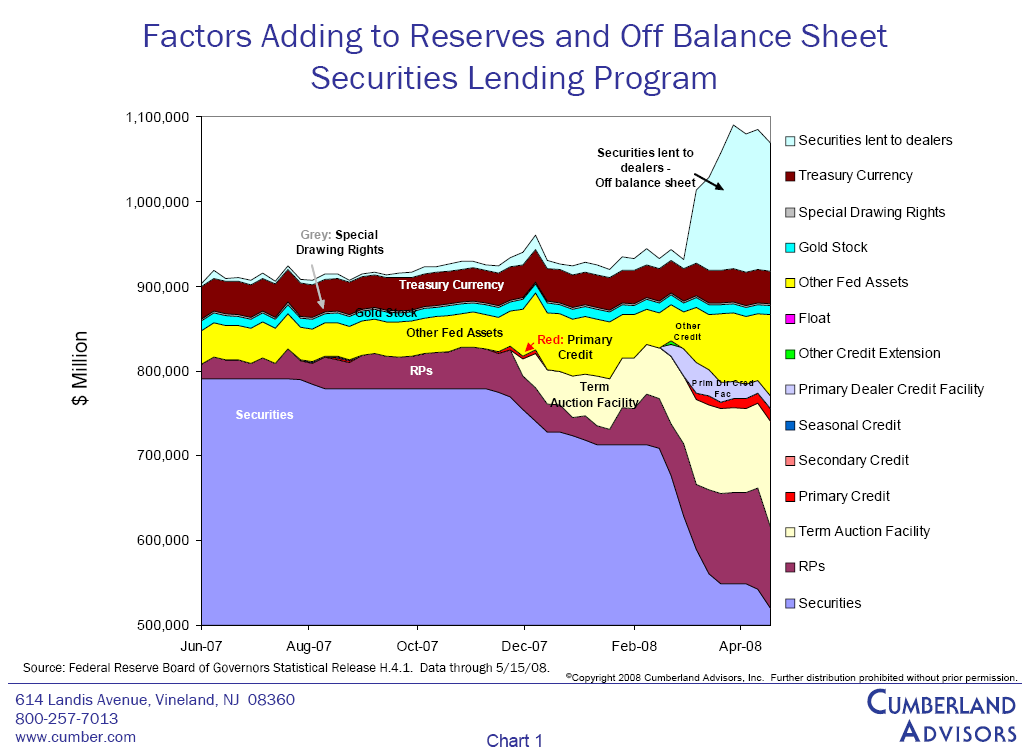

from: http://www.cumber.com/home/Factors.pdf

and:

from: http://www.treas.gov/tic/mfh.txt

Either quite a few people are over-reacting, and everything will be fine. This is just a glitch. Or they are right, and this is one of those once in a lifetime events, like the Great Depression.

Certainly the Central Bank bailout money seems to be continuously growing, not shrinking, which suggests to me that things are not getting better.

Comment

-

There's alot of information that you have posted and I'll try to have a look later this evening and respond, but just if I could in regards to the following comment...

I, personally, do not like comparisons between what is happening now and the Great Depression (though I realise it makes great press).Originally posted by Steve Netwriter View Post... and this is one of those once in a lifetime events, like the Great Depression.

I'm not saying that everything is hunky dory atm, but....

...in the "great depression" US GDP fell by over 25% in the period 1929-33 and the US unemployment rate was 25% in 1932.

There's a world of difference between those sorts of statistics and what we have seen to date.

And I don't expect we will get anywhere near those, btw.

MComments may not be relevant to individual circumstances. Before making any investment, financial or taxation decision you should consult a professional adviser.

Comment

-

OK Mark, I look forward to your reply.

I'm not suggesting a similar event by the way. Simply the importance of it. When people look back from 50 years time, will they list the 10 years from say 2006 as one of the important historical periods.

So it may not be "as bad" as the Great Depression, but the changes that occur may be as interesting and historically important.

I just feel like we're at one of those big times, that's all.

Of course we won't know for sure until 50 years time, by which time, I may not be around to know !

Comment

-

I've just come across this vid.

Trapper John M.D. M*A*S*H - Peter Schiff,Shut The F**k Up

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

Oh this cracks me up.

The interviewer near the beginning says "so it's a choice between Japan and the Great Depression"

A decade long slide into......

Or..............

Comment

-

gold

i like gold and believe there are good reasons to hold it, but the market seems easily manipulated, you would think with the negatives you hear in the financial world (high oil price, weakening US dollar, credit crunch etc) that the gold price would be steady or be slowly increasing but as i write this it's dropped to $US896 an oz, i remember the last time i checked a couple of days ago it was about $US930 an oz. I guess holding gold is definately a long term thing but it seems awfully volatile.

Comment

-

Gold is fluctuating daily however I believe the long term trend is up, When you look at gold in NZ dollars it does appear to be a little more stable. What is sometimes confusing for me is the prices quoted..... the US often quotes future contract prices which can be somewhat higher than the daily spot price.The mission of any business enterprise should include the aim to develop economic conditions rather than simply react to them.

Comment

-

Volatile can be good and bad.

It's good when the price rises

Yes, I agree short-term trading on gold can be a very quick way (but quicker is silver) to lose your money.

Long-term, if you think it is in a long-term bull phase, it offers two things:

1. Insurance. There is little else that offers a safe way to hold your money.

2. The potential for large gains versus those who do not hold it.

I did these yesterday just to show how 'bad' an investment gold & silver have been over the past year. It's easy to get glum on the very short-term moves.

On the longer picture things aren't so bad.

And yes, there are many who are convinced of manipulation. I am.

But there is a thing about manipulation. It cannot affect the long-term trend.

It can actually be viewed as good, because on dips it allows the ordinary investor to buy at a discount.

This article came up yesterday as well.

Related to previous things I've posted.

US and European debt markets flash new warning signals

By Ambrose Evans-Pritchard, International Business Editor

Last Updated: 6:40am BST 29/05/2008

The debt markets in the US and Europe have begun to flash warning signals yet again, raising fears that the global credit crisis could be entering another turbulent phase.

The cost of insuring against default on the bonds of Lehman Brothers, Merrill Lynch and other big banks and brokerages has surged over the last two weeks, threatening to reach the stress levels seen before the Bear Stearns debacle. Spreads on inter-bank Libor and Euribor rates in Europe are back near record levels.

Credit default swaps (CDS) on Lehman debt have risen from around 130 in late April to 247, while Merrill debt has spiked to 196. Most analysts had thought the coast was clear for such broker dealers after the US Federal Reserve invoked an emergency clause in March to let them borrow directly from its lending window.

But there are now concerns that the Fed itself may be exhausting its $800bn (£399bn) stock of assets. It has swapped almost $300bn of 10-year Treasuries for questionable mortgage debt, and provided Term Auction Credit of $130bn.

Remember this ?

Comment

-

I know Mark dislikes comparisons with the Great Depression, but this one just came up:

Through the floor

May 29th 2008

America's house prices are falling even faster than during the Great Depression

Checkout the graph !!!AS HOUSE prices in America continue their rapid descent, market-watchers are having to cast back ever further for gloomy comparisons. The latest S&P/Case-Shiller national house-price index, published this week, showed a slump of 14.1% in the year to the first quarter, the worst since the index began 20 years ago. Now Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century. This shows that the latest fall in nominal prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression. And things are even worse than they look. In the deflationary 1930s house prices declined less in real terms. Today inflation is running at a brisk pace, so property prices have fallen by a staggering 18% in real terms over the past year.

It wasn't me that said it

Comment

-

Now we have this one:

Recession? Maybe. Depression? Get real

Yes, the economy is in rough shape. But comparisons to the Great Depression are misguided.

and a reply to it:

CNNMoney.com's ‘Great Depression Comparisons Misguided' Conflicts with Historical Fact

May 30, 2008 - 01:28 PM By: Paul_Lamont

http://www.marketoracle.co.uk/Article4886.html

Comment

-

A good listen:

The Second Great Depression:

Started 2007/2008 Ending 2020,

Second Edition

Author Warren Brussee

Listen: http://www.netcastdaily.com/broadcas...008-0607-2.mp3

from: http://www.financialsense.com/fsn/main.html

Comment

-

Central bank body warns of Great Depression

June 9, 2008

by Gill Montia

KNOWLEDGE BASE: 2024's Ultimate Knowledge Base: All You Need to Know About Equity Release for Seniors. What Will You Learn?

KNOWLEDGE BASE: 2024's Ultimate Knowledge Base: All You Need to Know About Equity Release for Seniors. What Will You Learn?

The Bank for International Settlements (BIS), the organisation that fosters cooperation between central banks, has warned that the credit crisis could lead world economies into a crash on a scale not seen since the 1930s.

In its latest quarterly report, the body points out that the Great Depression of the 1930s was not foreseen and that commentators on the financial turmoil, instigated by the US sub-prime mortgage crisis, may not have grasped the level of exposure that lies at its heart.

According to the BIS, complex credit instruments, a strong appetite for risk, rising levels of household debt and long-term imbalances in the world currency system, all form part of the loose monetarist policy that could result in another Great Depression.

Comment

Comment