Cashflow properties, remember them. Back when a person just starting out could by a solid investment with a 7%+ ROI property? Back when people had this idea you could buy lots of properties and retire on the cashflow.

Lets say for argument sake the market doesnt crash and has a plateau. How long will it take for Median income to reach Median property price affordability to make 7% ROI for example in Auckland possible again (per area, ie not median Auck income to Invercargil Median house prices lol).

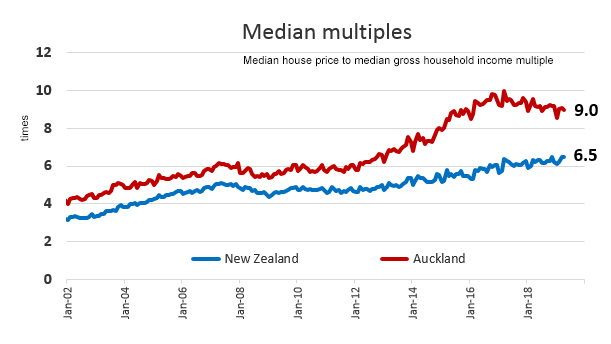

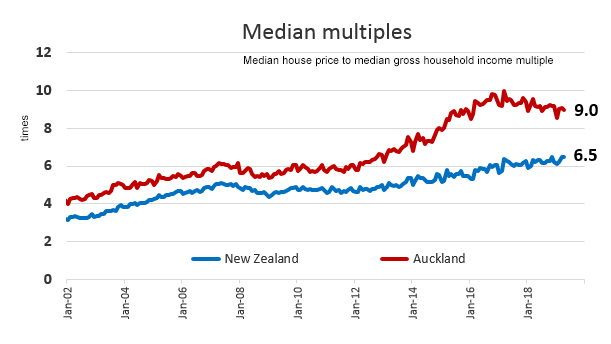

Im picking that plateua in will match the time for Local median income to increase enough to make property investment high ROI properties feasible again, so Im crystal balling 20 years if no further crash than the small one in Auckland which hasnt been passed on, but like everything in NZ things take time to reach rural NZ from Auckland ;-p I remember when 3 was the "Guru" figure to buy in median multiples (3x med income). Whilst both insane property booms screwed us, I feel it was the Key Boom (I dub it that as his borrowing during the GFC gave NZ a false sense of security) was the one that really pushed us OTT. 9.6x median multiple is just crazy stupid property.

Is it a "Boomers" conspiracy that has left nothing in the market for other generations (having had the money to invest in many properties and a boomer National PM print money during one of histories biggest financial crisis). Or was it just bad luck. Its like a cricket match and the boomers at bat and in the field and the umpires call, everything has rubbed their way. So its hard not to be cynical. But the logical side of me just says its pure luck and Boomers were the generation when good things in the world ended, or the in between generations were left without the old good things or the new good things. Thats my thoughts, I find it hard to believe J Key deliberately set the property market up to make shed loads of money in capital gains for his natty boomer voters. But I sure do miss the 8% PA years from a renovate and hold perspective. Its hard to grow the funds to buy the renovation property in Auck, almost none are left, nobody is willing to consider 20% below MV and then when you go to keep it, 2-3% ROI is generous lol. Its like an old gold mine river, with pickers still fooling themselves with the odd 1gram nugget giving false hope.

Meanwhile my index fund is returning 15.6%, given its so hard to borrow/leverage for ASX, should I sell a property instead and just keep a hawk eye on it until it too has its nose dive. Is the only way I can think to get large amounts of money into stocks while they run hot. Is it smart to lend yourself money that you cannot get from anybody else by selling an investment returning much less than half, more like a third.

I dont have much faith in the fund running this hot for more than 2 years, but if it evens out at 10% over 5 years Im stoked.

Lets say for argument sake the market doesnt crash and has a plateau. How long will it take for Median income to reach Median property price affordability to make 7% ROI for example in Auckland possible again (per area, ie not median Auck income to Invercargil Median house prices lol).

Im picking that plateua in will match the time for Local median income to increase enough to make property investment high ROI properties feasible again, so Im crystal balling 20 years if no further crash than the small one in Auckland which hasnt been passed on, but like everything in NZ things take time to reach rural NZ from Auckland ;-p I remember when 3 was the "Guru" figure to buy in median multiples (3x med income). Whilst both insane property booms screwed us, I feel it was the Key Boom (I dub it that as his borrowing during the GFC gave NZ a false sense of security) was the one that really pushed us OTT. 9.6x median multiple is just crazy stupid property.

Is it a "Boomers" conspiracy that has left nothing in the market for other generations (having had the money to invest in many properties and a boomer National PM print money during one of histories biggest financial crisis). Or was it just bad luck. Its like a cricket match and the boomers at bat and in the field and the umpires call, everything has rubbed their way. So its hard not to be cynical. But the logical side of me just says its pure luck and Boomers were the generation when good things in the world ended, or the in between generations were left without the old good things or the new good things. Thats my thoughts, I find it hard to believe J Key deliberately set the property market up to make shed loads of money in capital gains for his natty boomer voters. But I sure do miss the 8% PA years from a renovate and hold perspective. Its hard to grow the funds to buy the renovation property in Auck, almost none are left, nobody is willing to consider 20% below MV and then when you go to keep it, 2-3% ROI is generous lol. Its like an old gold mine river, with pickers still fooling themselves with the odd 1gram nugget giving false hope.

Meanwhile my index fund is returning 15.6%, given its so hard to borrow/leverage for ASX, should I sell a property instead and just keep a hawk eye on it until it too has its nose dive. Is the only way I can think to get large amounts of money into stocks while they run hot. Is it smart to lend yourself money that you cannot get from anybody else by selling an investment returning much less than half, more like a third.

I dont have much faith in the fund running this hot for more than 2 years, but if it evens out at 10% over 5 years Im stoked.

Comment