STUPID TAX LAW - BE VERY CAREFUL WITH NOMINATIONS!

Consider this: You buy a section off the plans for your personal home. You put your personal name or nominee on the agreement as you need to discuss with your advisors which entity to put the section under. You then nominate your Family Trust. Surely there can't be any tax issues? It's going to be your personal home too!

Well, there could be unexpected tax consequences. If you are buying a residential property, and then nominating another entity, you need to consider the 2 year Bright-line test.

We are finding this situation is coming up quite often and we think the rules around this are a joke!

Bob signs a Sale and Purchase Agreement to buy a section for $200,000 in January 2016 to build his personal family home.

In October 2016, Bob has now established a Family Trust. Bob nominates the Family Trust as the purchaser. The market has jumped in value and the section is worth $300,000 at this time (October 2016). Title is then available in January 2017, when Bob's Family Trust settles on the property.

SUGGESTIONS:

If you are looking at purchasing a property, ideally put the correct purchaser on the Sale and Purchase Agreement to start with.

If this isn't possible, then as soon as you are able to nominate the correct entity, get proof of the values (and keep this), and if there is no change in value, nominate the new party.

If there has been an increase in value, then you might have to wait until you can transfer the property into the correct entity without being taxed by the Bright-line Test (either after two years or once personal home test satisfied - it is worth checking this timing with an expert!).

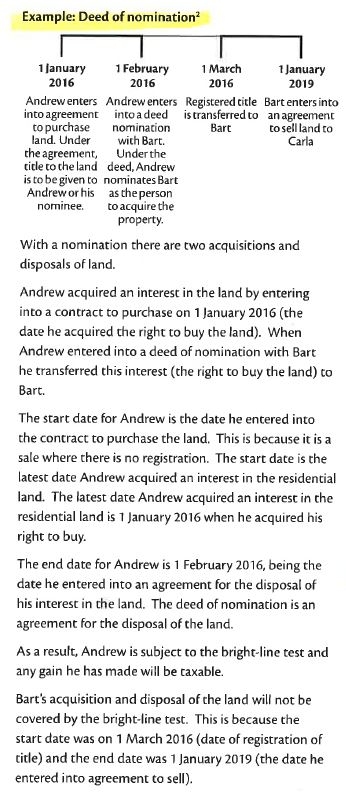

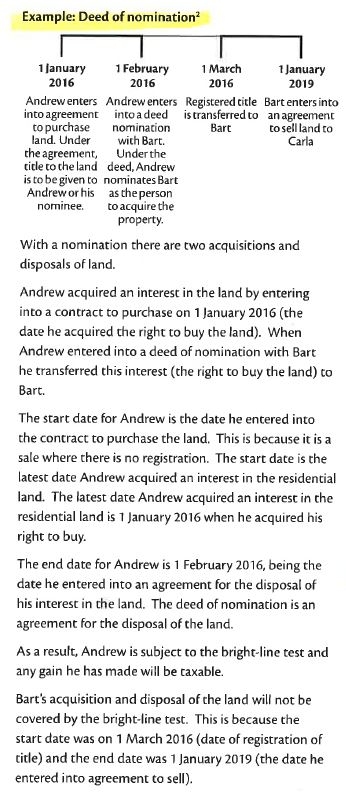

See relevant excerpt below from IRD Tax Information Bulletin.

Kind regards

Ross Barnett

Consider this: You buy a section off the plans for your personal home. You put your personal name or nominee on the agreement as you need to discuss with your advisors which entity to put the section under. You then nominate your Family Trust. Surely there can't be any tax issues? It's going to be your personal home too!

Well, there could be unexpected tax consequences. If you are buying a residential property, and then nominating another entity, you need to consider the 2 year Bright-line test.

We are finding this situation is coming up quite often and we think the rules around this are a joke!

Bob signs a Sale and Purchase Agreement to buy a section for $200,000 in January 2016 to build his personal family home.

In October 2016, Bob has now established a Family Trust. Bob nominates the Family Trust as the purchaser. The market has jumped in value and the section is worth $300,000 at this time (October 2016). Title is then available in January 2017, when Bob's Family Trust settles on the property.

- IRD treat the nomination as a sale. So for the 2 year Bright-line Test - purchased January 2016 and sold October 2016, which is within two years.

- You might be thinking 'No worries, there is personal home exemption'. WRONG. This is just a section, so isn't Bob's personal home yet, so NO EXEMPTION.

- Or, 'Surely there is something in the rules to allow for related party transfers like this'. WRONG. There is no allowance in the Bright-line Test for related party transfers (this is an area where you have to be particularly careful!).

SUGGESTIONS:

If you are looking at purchasing a property, ideally put the correct purchaser on the Sale and Purchase Agreement to start with.

If this isn't possible, then as soon as you are able to nominate the correct entity, get proof of the values (and keep this), and if there is no change in value, nominate the new party.

If there has been an increase in value, then you might have to wait until you can transfer the property into the correct entity without being taxed by the Bright-line Test (either after two years or once personal home test satisfied - it is worth checking this timing with an expert!).

See relevant excerpt below from IRD Tax Information Bulletin.

Kind regards

Ross Barnett

Comment