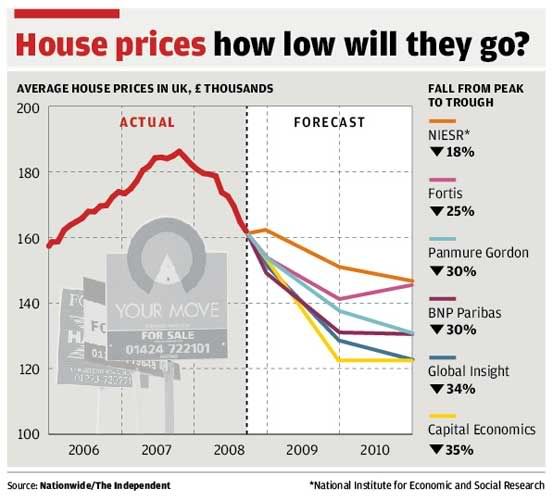

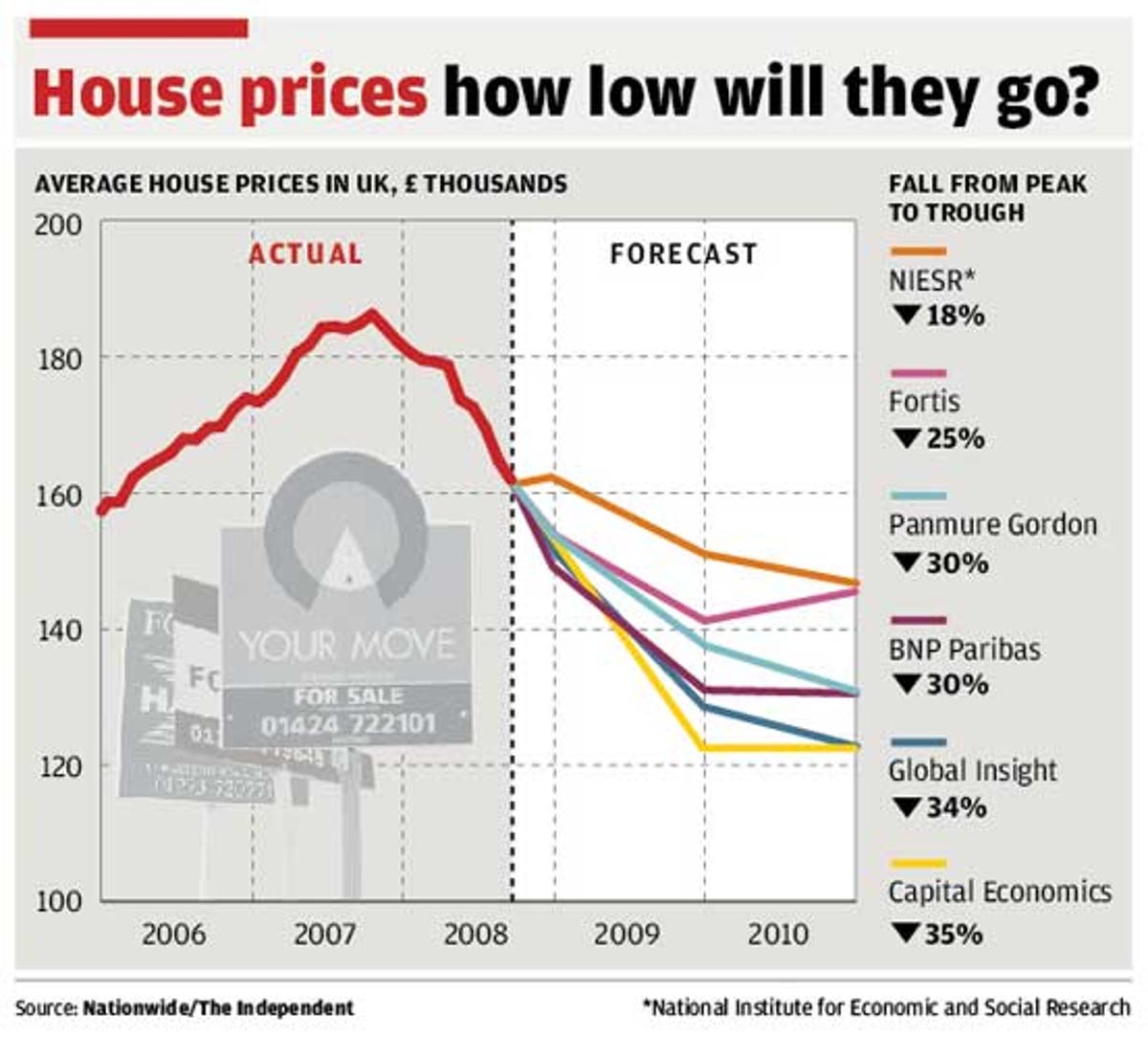

I have a feeling that although todays figures show the sharpest drop in the Nationwide index history that there is little more to drop, I base this theory on a number of factors.

Firstly there is still a huge shortage of houses in the uk and therefore a large demand, the employment figures are historicaly excelent and although down on last year, last month showed an increase in mortgages granted compared to the month before.

I believe that soon we will have adjusted to high energy costs as they appear to be here to stay and also sterlings position in the markets once these mental adjustments have taken place confidence will begin to return and early next year we will see once again record numbers of people moving into the investment property overseas market and in my case hopefully a large portion of that to the Portuguese sector.

ppp

Firstly there is still a huge shortage of houses in the uk and therefore a large demand, the employment figures are historicaly excelent and although down on last year, last month showed an increase in mortgages granted compared to the month before.

I believe that soon we will have adjusted to high energy costs as they appear to be here to stay and also sterlings position in the markets once these mental adjustments have taken place confidence will begin to return and early next year we will see once again record numbers of people moving into the investment property overseas market and in my case hopefully a large portion of that to the Portuguese sector.

ppp

Comment