Most people are fixed on low rates though Ant so you are only talking about those floating or about to come off fixed who would be affected. And it is not going to happen for years according to all the global coneheads.

Announcement

Collapse

No announcement yet.

NZ mortgage giant warns of 'outright house price fall

Collapse

X

-

Originally posted by Bobsyouruncle View PostWon't affect Auckland much, if at all. The GFC didn't do much to Auckland prices and that was the biggest hit since the depression.

Never learn.. How many people will go bankrupt this time with a 10% drop. How many will go down with a 30% drop? Anything is possible. S**t happens.. Good luck.. Hope u stached millions overseas

Comment

-

Gosh that's a bit tough. I'd say Dean has learned a lot:Never learn..

How to put everything in a trust.

How to put everything else in your wife's name.

How to cover you butt really really well.

How you can go bankrupt 3 times and still act like a big noter - and many people will listen to you.

I'd say he's quite clever in some respects!Squadly dinky do!

Comment

-

No doubt he is clever to protect himself... but he has no regard for anyone else. He has been in the same tune of "Auckland prices will never drop or drop a little bit" for personal benefit disreagarding what would happen to poor souls follow him just like last time around.

Originally posted by Davo36 View PostGosh that's a bit tough. I'd say Dean has learned a lot:

How to put everything in a trust.

How to put everything else in your wife's name.

How to cover you butt really really well.

How you can go bankrupt 3 times and still act like a big noter - and many people will listen to you.

I'd say he's quite clever in some respects!

Comment

-

No one fixes long term here, most are on 6month to 2year rates. Say on average (averaging the 5 & 7yrs with the 0.5s and 1s) everyone was on 2 years, a quarter of them will be expiring within in six months. Then add on all the (probably few) floaters holding out for the next rate drop, and you're looking at big numbers, that keep getting bigger every month for the next two years. I'd argue a moderate but extended drop that keeps getting worse for two years is worse for the market than an immediate sharp dropoff that starts to improve quickly.Originally posted by Bobsyouruncle View PostMost people are fixed on low rates though Ant so you are only talking about those floating or about to come off fixed who would be affected. And it is not going to happen for years according to all the global coneheads.AAT Accounting Services - Property Specialist - [email protected]

Fixed price fees and quick knowledgeable service for property investors & traders!

Comment

-

Legal verses moral.Originally posted by Beginner1 View PostNo doubt he is clever to protect himself... but he has no regard for anyone else. He has been in the same tune of "Auckland prices will never drop or drop a little bit" for personal benefit disreagarding what would happen to poor souls follow him just like last time around.

That was Trumps line also - going bankrupt was legal, why wouldn't you to get out of paying debt?

Comment

-

And you forgot to say...Originally posted by Davo36 View PostGosh that's a bit tough. I'd say Dean has learned a lot:

How to put everything in a trust.

How to put everything else in your wife's name.

How to cover you butt really really well.

How you can go bankrupt 3 times and still act like a big noter - and many people will listen to you.

I'd say he's quite clever in some respects!

How to use Religion as a tool to make people trust you in the name of god

How to sell sections in known flood zones to his disciples

How to be visiting houses in Auckland while being in Fiji on mission work at the same time

How to use more alias' than any other individual in the history of Property Talk

How to get banned one day from here and come back the next with a new name and carry on as if nothing happenedFacebook Property Chat Group NZ

https://www.facebook.com/groups/340682962758216/

Comment

-

Not sure what you mean. I invest on the expectation that real estate will continue to double in value on average every ten years as it has always done. Not that I need it to but it's comforting.I hope you aren't investing on that expectation...

And that Auckland is the most robust and safest market in New Zealand.

I certainly wouldn't be buying much in Auckland right now though until the banks and govt stop changing the rules every 5 minutes. I had enough of surprises in the GFC. But if I was starting out I would only buy in Auckland or Hamilton. And I would find a way to buy something now as it is only going to get dearer.

It's all well and good to be mindful of short term shocks and things that can happen, we are after all in uncharted waters. But it's dumb in my opinion ot be bagging Auckland as a market. it is bullet proof to use Gilligans expression for the foreseeable future.

Another few years it is likely to be even more similar to places like Melbourne and London where the rich can afford to live there and the rest can't. Only a global problem will stop or slow that process and it will of course bounce back anyway, that's the nature of real estate.

Comment

-

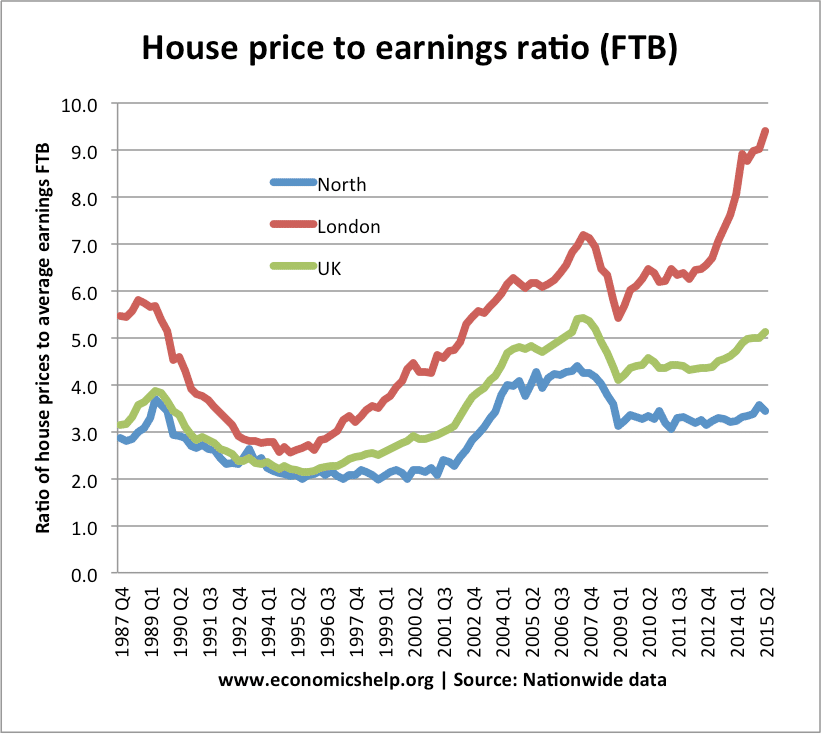

1 : 6 in Auckland in 2007 peakOriginally posted by Nick G View PostWhat were Auckland incomes to prices ratio going into the GFC.

.

1: 10 now??

We may see some fireworks at the end of this cycle

Comment

-

London of the East eh..Originally posted by Bobsyouruncle View PostNo different to London.

It will just keep going. Eventually wages will catch up a bit in the next slump but it just is what it is. Welcome to Auckland.

So we shouldn't worry if DTI was 1:4.5 in Auckland. It will be fine just like London :P Bring it ON.Last edited by Beginner1; 28-10-2016, 10:47 AM.

Comment

Comment