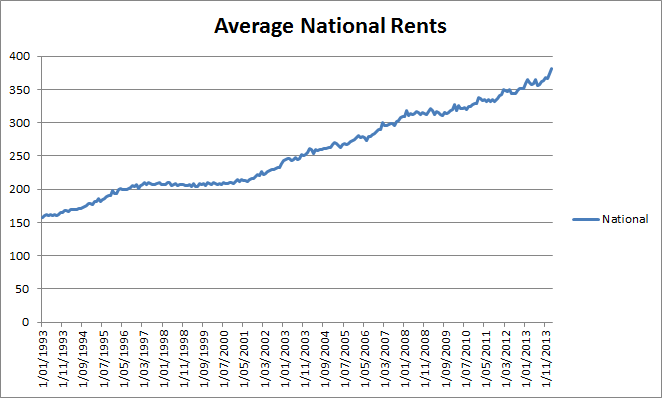

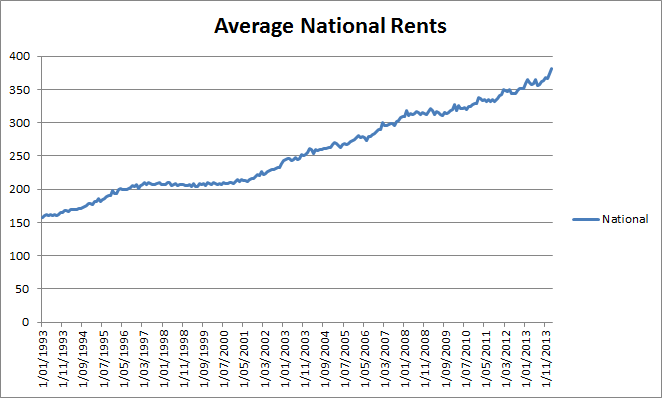

So I was looking at the average rent data from the Department of Building and Housing, did up a quick graph. The years between 1996 and 2001 show five years of static / declining rents. Was anyone around at that time? What was happening in the industry?

Comment